BBVA Next Technologies Unfixed (Case Study of a FinTech Unit)

Author: Jurgen Appelo

I like the term organized chaos. It signals that something looks messy and anarchistic at first sight but that there's still a level of reasoning and control behind it. Organized chaos is also the term some employees of the Spanish company BBVA Next Technologies use to describe their organizational structure and ways of working. And they mean this in the best possible way. 😉

Introduction

BBVA is the second-largest Spanish bank with 111,000 employees operating in twelve geographies worldwide. The bank has around 15,000 people working in the Engineering unit and an additional 800 employees working at BBVA Next Technologies, a company 100% owned by BBVA. BBVA Next Technologies aims to help its parent company acquire the necessary knowledge and experience to introduce next-generation technologies.

For any large company that operates in a traditional environment (such as the world of banking), it can be rather difficult (or even impossible) to introduce disruptive innovations from the inside. It is easier to delegate modernization to a fully-owned subsidiary acting like an outsider, which can then feed the necessary change to the mother company at a pace the parent can swallow. This is precisely what BBVA has done with BBVA Next Technologies.

In this case study, I evaluate the current organizational structure of BBVA Next Technologies and compare it with patterns of the unFIX model to see what either can learn from the other.

Delivery Team

At BBVA Next Technologies, around 85% of the company is the Delivery unit, which comprises all employees working on projects at the parent company BBVA. Besides the bank, BBVA Next Technologies is also involved in a few projects for other clients, mainly to learn about new technologies and innovations. However, 95% of the work in Delivery is done exclusively for the parent company.

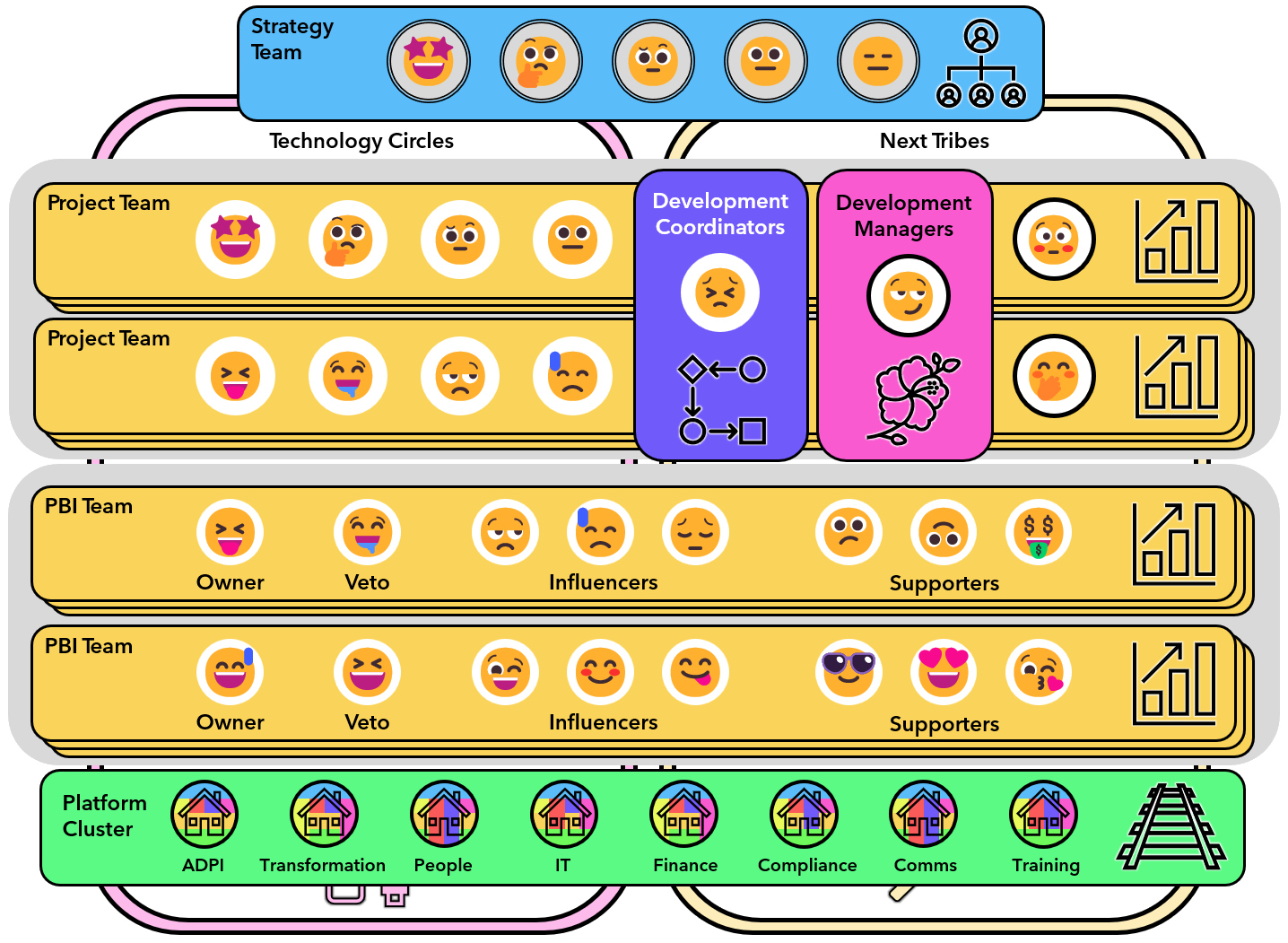

Figure 1: Project Teams in Delivery Unit

Because the bank treats its subsidiary BBVA Next Technologies as a (preferred) supplier, BBVA Next Technologies writes offers and proposals for its customer like any other vendor. BBVA Next Technologies does not own or control any of the bank's projects. Instead, a proper description of their involvement would be that they are hired on time/material projects by the bank's project managers and other stakeholders. BBVA Next Technologies supports BBVA in its product development wherever help is needed. The bank typically relies on BBVA Next Technologies for strategic projects requiring crucial expertise or innovations.

The employees of the Delivery unit usually work on the same projects for several years, and each project has its own approach to development method, product backlog, project management, etc. The Head of Delivery works with 13 Delivery Managers (who act as the face of BBVA Next Technologies to the stakeholders at the bank), each overseeing around 75 IT professionals and a handful of Delivery Coordinators (who act as servant leaders in one or more projects). The Delivery Coordinators officially report to the Delivery Managers, but the IT professionals don't. Instead, they have their own HR Partner elsewhere at BBVA Next Technologies, responsible for placement, compensation, etc. The benefit of this setup is that when IT professionals move across projects, they may end up with different Delivery Coordinators and other Delivery Managers, but they will always keep the same HR Partner.

On paper, the structure of the Delivery unit looks like a standard matrix organization. The IT professionals have their functional managers outside the projects while at the same time working directly with Delivery Coordinators (and their Delivery Managers) and with project managers or other stakeholders at the bank. This means a lot of management coordination is happening around the projects.

Delivery Unfixed

Can this be organized differently? And would that be advisable?

You could say, "Never change a working program." When there are no significant problems, there is little reason to change. Unnecessary transformations could make things worse instead of better. On the other hand, it is also wise to look ahead, anticipate possible problems looming on the horizon, and prepare for what might be coming. In general, matrix organizations suffer from slow, fat middle management layers that spend a lot of time on coordination, which may work well enough in a banking environment with money to spare on plenty of resources. However, to survive in more difficult times ahead, the company might benefit from an organization design that is faster and leaner.

My best guess is that the Delivery unit could steadily reorganize itself into multiple smaller Bases organized around specific customer value propositions, such as Machine Learning expertise, Crypto expertise, Data Mining expertise, and so on. If the purpose of BBVA Next Technologies is to offer knowledge and experience in various next-generation technologies, it will do well to form small units (led by teams of Development Managers and HR Partners) comprised of IT professionals and specialized Development Coordinators who love to offer their skills as the best available in the market.

Figure 2: Suggested Alternative for Delivery Unit

I conjecture that when IT professionals feel a stronger sense of belonging to a smaller unit of specialists in a particular technical area, they will work harder to become and stay the best in that area. They might then aim for shorter project engagements with the customer and would try harder to disseminate their expertise and skills inside the bank because specialists often prefer not to be locked in the same project for too long. This would benefit both BBVA Next Technologies and the bank.

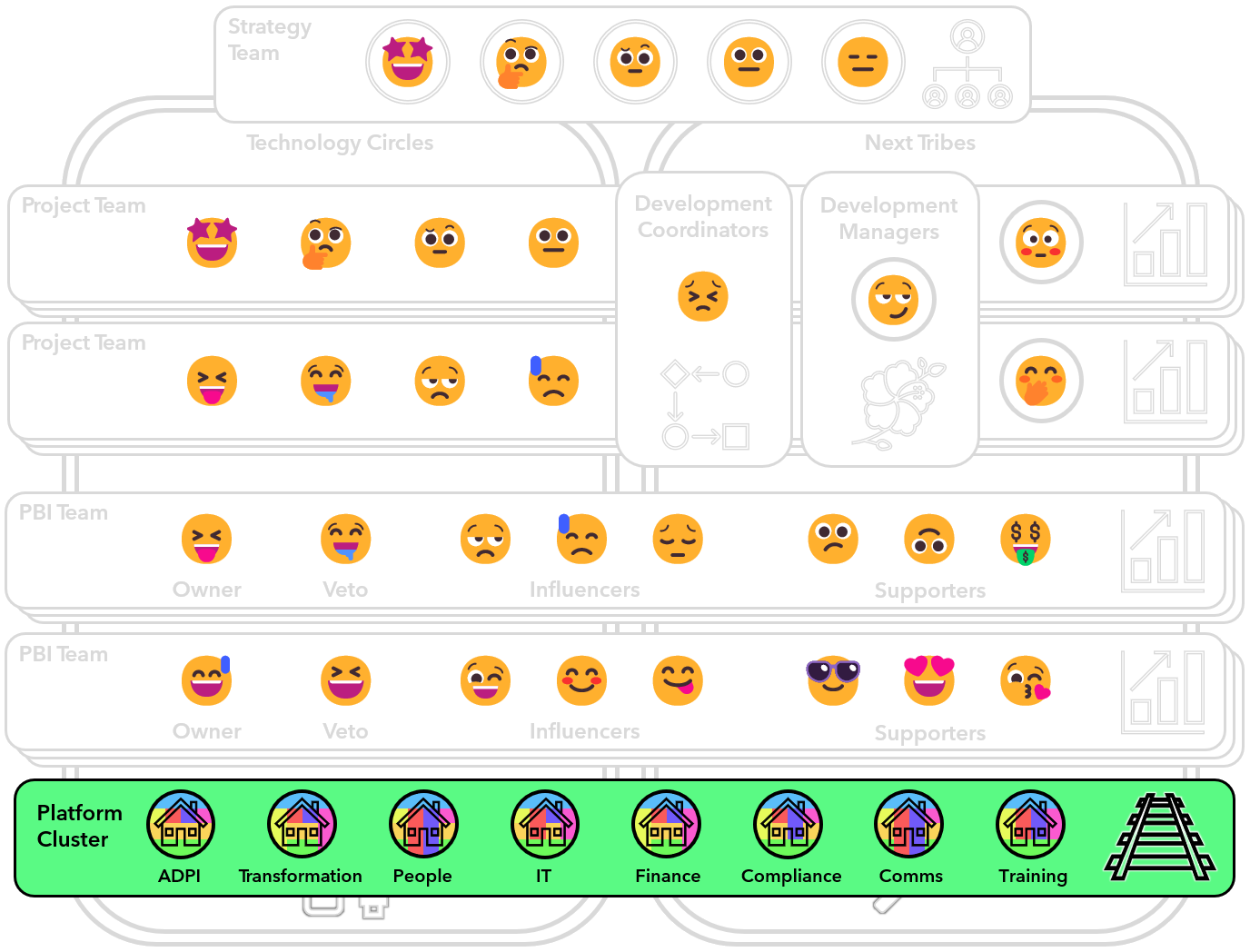

Platform Units

As I wrote earlier, the Delivery unit forms about 85% of BBVA Next Technologies. Several other teams take up the other 15%. The biggest one, with 20-30 people, is called ADPI, the unit that develops the applications BBVA Next Technologies uses internally to manage the company. The ADPI unit has dedicated team members and some engineers joining temporarily when they have no current project for the bank. The ADPI unit covers front-end, back-end, DevOps, and QA, and it has ProductOwners and a Scrum Master, all of whom report to the ADPI manager.

Figure 3: Support Units in Platform Cluster

The ADPI unit fully participates in the quarterly goal-setting process (described below), which means that the teams within this unit are reformed each quarter depending on the selected objectives. They often create their own mix of Scrum and Kanban, and the ProductOwner relationships change every quarter. It is easy to recognize the ADPI unit as a separate Base with one Chief as the manager and a quarterly cadence of reteaming. No other patterns are applicable here besides the Chiefs and the Value Stream Crews.

In addition to the Development unit, several other smaller units exist, such as Change/Transformation, Finance, People, IT, and Comms. Each of these business functions has a manager, and we can consider these units to be examples of small Bases with one Chief each. Because they all work together, offering various business services to the company, it seems appropriate to see them as a Platform Cluster.

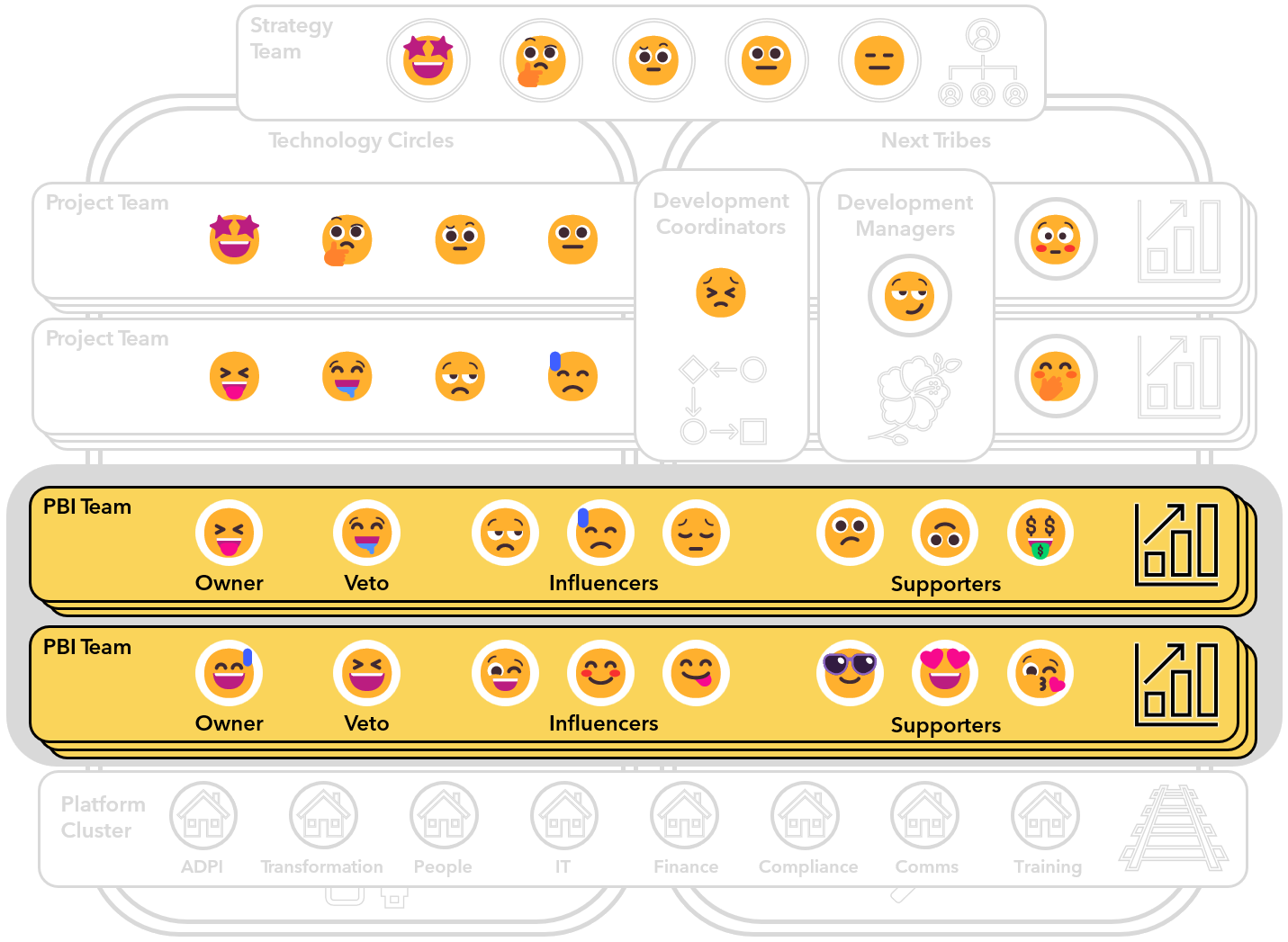

Strategy Team and Annual Goals

BBVA Next Technologies has a Strategy Team consisting of a CEO and four other Chiefs. They work as a typical Governance Crew, managing the business and representing it to the outside world. One of the most important jobs of a Governance Crew is to watch over the long-term health of the business. BBVA Next Technologies realized that to keep offering next-generation talent and technologies to its parent, the company needs a next-generation approach to its employee experience and continuous improvement efforts. After all, it is hard to work on disruptive innovations when no good engineers want to work for you.

Figure 4: Strategy Team

For this reason, the Strategy Team sets annual goals that they call strategic Building Blocks. The company's current goals go by the titles "Employee Value Proposition", "Add More Value to the Bank", "Sharing Knowledge", and "Next Level Enterprise". Each of these Building Blocks is divided into a small number of Programs. For example, "Evolution of the Delivery Manager" is one Program within "Add More Value to the Bank". Underneath each Program, there are several Product Backlog Items (PBIs) that are, in most cases, suggested by the employees throughout the company. Such PBIs could be, for example, "New Training Programs", "New Way of Working", and "Homecoming (new office in Bilbao)".

Figure 5: Goal-Setting Framework

The Strategy Team normally updates the Building Blocks once per year, and these goals sometimes go on for another year. But they can also be updated in the middle of a year when, for example, the parent bank communicates an updated strategy that impacts its subsidiary. Likewise, the Programs within the Building Blocks are stable throughout the year, but they can sometimes change. Each strategy team member is responsible for precisely one strategic Building Block, and they usually lead the Programs within those goals (with some exceptions). However, things get much more interesting when we look at the PBIs within the Programs.

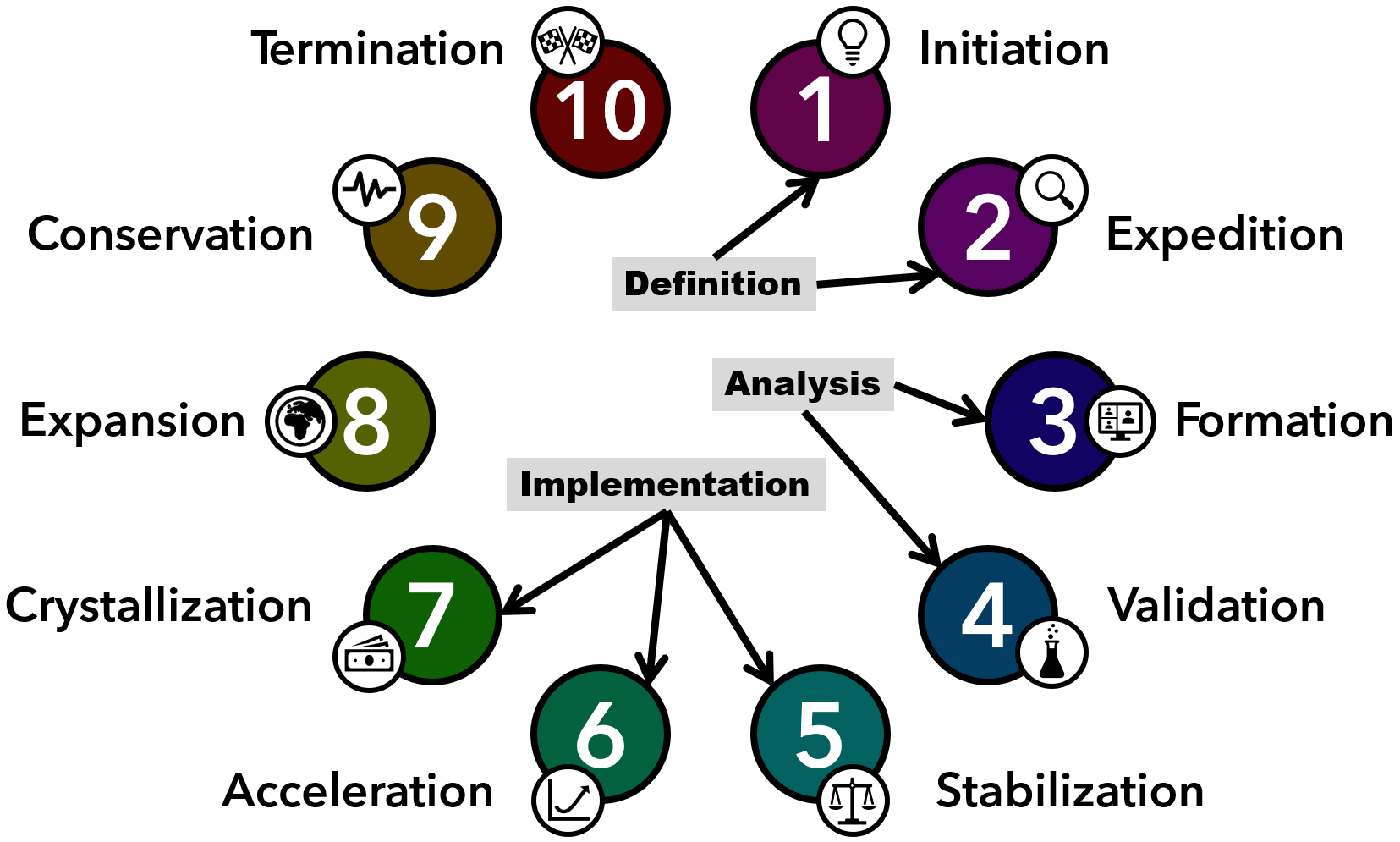

Lifecycle Stages of Objectives

Everyone within BBVA Next Technologies can propose a new objective (PBI) using an online form. The company prides itself on a high level of psychological safety which is evident from a large number of proposals that the employees submit each quarter, some of which point to serious issues that require a resolution. In other words, when something is wrong, the Strategy Team is sure to hear about it!

The PBIs come in different types: Definition, Analysis, and Implementation, enabling employees to distinguish three stages of problem resolution. It makes sense first to evaluate what everyone learned from Problem Definition before moving on to Analysis, and the Implementation of an idea should only get the green light when Analysis generates positive results. (The learnings from Problem Definition or Analysis might reveal that Implementation is not needed or not feasible.)

The three stages seem to be a condensed version of the various stages of the business lifecycle. Definition is initiating the problem space (1) and a exploring a possible solution (2). Analysis is forming support to solve the problem (3) and validating which approach has a good chance to work (4). Implementation is stabilizing before rollout (5), accelerating the rollout (6), and finishing with a crystallized working solution (7). (The final three sunset stages of ideas are not covered by PBIs at BBVA Next Technologies.)

Figure 6: Lifecycle Stages

BBVA Next Technologies employees must not confuse an idea's lifecycle stages with the waterfall phases of traditional project management. In a Lean-Agile approach, each lifecycle stage consists of experiments and feedback cycles. Ideas grow to the following stages (or else they die) depending on the learning rate from running tests. I would suggest renaming the PBI stages to Exploration, Validation, and Implementation to prevent confusion with waterfall phases.

Priorities and Owners of Objectives

All proposals for objectives arrive at the Strategy Team, who select the ones with the highest priorities during their quarterly Strategy Week. This is not a very structured meeting, as they admit themselves. It involves hours of passionate discussions between the five Strategy Team members. The output of the Strategy Week is a prioritized list of PBIs. (Not surprisingly, any regulatory and compliance objectives related to the banking environment get the highest priority, and PBIs that emerge out of the Delivery unit usually get a high priority as well.)

Figure 7: Owner and Veto roles

Every PBI has a PBI Owner (a role that's similar to a Product Owner). These are often dedicated members of the Change/Transformation unit, but it's also possible for other employees to end up as the Owner of one of the objectives. Employees can offer to work on any PBI, and the Strategy Team takes everyone's preferences into account, but sometimes they override them. On average, about three times out of five, employees get ownership of the PBI that they proposed and signed up for. (In some cases, they even volunteer for and become Owner of a PBI they know nothing about with the intention to learn something new.)

In addition to the Owner role, each PBI also has a Veto role which is always a member of the Strategy Team. The Strategy Team makes an initial decision about the Owner and Veto roles per PBI.

Note: The Veto role is usually taken by someone from the Strategy Team who is not also the leader of the Building Block and Program that the PBI belongs to. This ensures that, ultimately, for each PBI, two Strategy Team members are involved: one owns the Building Block, and the other has the Veto role.

And then, the organized chaos unfolds.

Objective Teams

Each PBI has two additional roles apart from the Owner and Veto roles. They have Influencers (the employees doing the work on the objective) and Supporters (others who need to be consulted or informed). The Strategy Team leaves it to the PBI Owners to find co-workers across the company to fill in the Influencer and Supporter roles.

Figure 8: Influencer and Supporter roles

After the publication of all PBIs and their priorities, the Owners start forming teams on the fly with a somewhat unstructured open allocation approach. For each of their PBIs, they try to recruit Influencers and Supporters from all over the company. The employees across all units can decide which PBIs they want to contribute to, and they can commit to being involved in multiple PBIs, depending on how much time they have available.

While committing to a role for a PBI, employees consider the prioritized list. They all know that the ones near the top are more important than those below. This means that the owners of PBIs down the list have a more challenging time forming teams than those near the top. Furthermore, for each PBI they manage, they must decide how they want that team to work: how to organize the work, how often to meet with Influencers, how to engage Supporters, and so on.

Typically, employees from the Change/Transformation unit end up being the Owner of multiple PBIs in different Building Blocks. It's not a big problem for them if they cannot get a complete team for low-ranking PBIs. They probably have enough to do for the high-ranking ones, and there's only so much one can do in a quarter.

Figure 9: PBI Teams

After the Strategy Week, the entire process of forming teams around PBIs can last at least a month. The latest moment to get Influencers and Supporters for a PBI is during a Commitment Meeting that lasts around two to three hours. After that, all commitments are closed, and the wisdom of the crowd has determined how many PBIs the whole company could sign up for. (At the time of writing, BBVA Next Technologies had 42 PBIs in progress.)

Capacity and Investment Horizons

The work that people do on PBIs comes on top of everyone's regular work, also referred to as Business As Usual (BAU). This means that everyone must estimate how many objectives they can commit to. Engineers from the Delivery unit who work on projects at the parent bank find it harder to commit to working on PBIs than employees in the other units. And for those who work in the ADPI and Change/Transformation units, it is the other way around: nearly everything they do in these units is related to PBIs.

The other platform units (Finance, Comms, Training, IT, etc.) have to find their balance between BAU and PBIs. This means they need a way to decide how much of their capacity they can allocate to PBIs while BAU has priority for everyone. Typically, the Platform units give around 80% of their time to regular work and 20% to change and transformation, but they do so differently. In some departments, they make a clear distinction between BAU teams vs. PBIs teams because otherwise, BAU tends to absorb all available capacity. In other units, the separation of BAU versus PBIs is handled at the individual level. Both approaches have benefits and drawbacks, and I believe it is wise that a choice is made at the level of each unit.

The struggle between BAU versus PBIs is described with the four investment horizons faced by every business. At BBVA Next Technologies, Business As Usual corresponds with Maintenance, while PBIs correspond with Improvements, Extensions and Disruptions. The company must seek a balance in investments between these four horizons.

Figure 10: Investment Horizons

BBVA Next Technologies understands it must continuously change and reinvent itself to help the parent company find its way to the future. Somehow, sufficient time for change and transformation must be allocated and protected across the company.

Multi-Teaming and Continuous Flow

The PBIs are supposed to be finished at the end of the quarter. As can be expected, this often doesn't work out quite as people had hoped and estimated. Depending on the type of PBI, in some cases, the scope is cut to fit the remaining time in the quarter. In other instances, unfinished PBIs get resubmitted and reprioritized for another three months. And some teams somehow find the time for a final crunch to finish their PBI just before the deadline.

Each PBI is finalized with a "Start, Continue, Stop" retrospective to capture the lessons learned, distribute kudos among team members, and share learnings with the rest of the company. The PBIs of the previous quarter are closed while the PBIs of the next one are in preparation. This means that everyone has several weeks to finish their previous PBIs while getting ready for the next ones between the Strategy and the Commitment Meeting.

One obvious thing to note is that BBVA Next Technologies allows employees to work on multiple teams simultaneously. Any employee could have a BAU team and one or two PBI teams that they are involved in. As Tim Harford said in his TED talk on "slow-motion multitasking", creativity benefits from people moving between different contexts. As long as they aren't literally trying to do those projects simultaneously, multi-teaming has my full support. In practice, BBVA Next Technologies has two parallel structures in place: the (static) BAU structure and the (dynamic) PBIs structure.

Figure 11: BBVA Next Technologies

But there's one thing I might offer as a suggestion: to get rid of the quarterly cadence of PBIs and replace it with a continuous flow. In my post "flOwKRs - Objectives and Key Results in Flow" and the Pipedrive case study, I show that a company might benefit from decoupling objectives from the calendar. With a continuous flow of objectives, instead of sizing objectives to fit rigid quarters, it can be easier to set timeboxes around flexible objectives. A constant flow allows employees to work on fewer objectives of different sizes and complete them earlier. Limited Work In Progress (WIP) applies not only to tasks but also to goals.

Forums, Guilds and Circles

The distinction between regular work (Business As Usual) versus change and transformation (PBIs) is not the only time management decision that the employees of BBVA Next Technologies need to make. Several other contexts exist for employees to collaborate and coordinate across team boundaries.

Next Tribes are similar to Guilds or Communities of Practice. These tribes (that I would call Forums) exist for all employees to share ideas and experiences around data protection, cloud services, Agile, and other topics. All employees, including those from Delivery who work on projects in the bank, can use up to 20% of their time to participate in such Forums. For example, one of the initiatives that have emerged out of the Next Tribes is the organization of an annual agile conference in Madrid.

Figure 12: Technology Circles and Next Tribes

In addition, an Architecture committee gets together once every two weeks to discuss architectural matters with representatives from across the company. The front-enders also get together for front-end discussions across all units, and the same applies to the back-enders. The company has various Technology Circles oriented around specific tools and technologies, and, last but not least, the PBI Owners organize themselves in an online Change Corner group and three or four conversations per year to discuss everything related to PBI ownership and the quarterly goal-setting process.

Remote and Hybrid Working

Like many organizations, BBVA Next Technologies has embraced hybrid working, meaning employees can work from home and in multiple offices around the country. Each employee can have up to five official addresses to work from; in practice, around half of the workforce works 80% to 90% remotely. While a small number of projects and ceremonies require people to be on-site, most of the work can be done from anywhere. Overall, the company has decided that everyone has the right to work remotely for at least 60% of their time.

The Employee Experience

From the various interviews I did with people at BBVA, I noticed a significant sense of enthusiasm and even pride about the way of working at the company and the shared employee experience. And that is by design.

Turnover ratios of highly qualified professionals can be a big problem for any financial company. Hiring a new person each time someone leaves is a big pain for HR and the bank. BBVA has been wise to delegate learning and innovation with next-generation technologies to a wholly-owned subsidiary where people feel much more autonomy and responsibility for their work than in a traditional banking environment.

The BBVA Next Technologies approach to the employee experience is exemplified in a regular company-wide survey that the People unit uses to analyze and predict how people feel about the company and when they might risk losing someone to the external market. Twice per year, the survey polls all employees—who can choose to remain anonymous—about demographics, psychometric profiles, and personal motivation. Part of the survey is based on Management 3.0's Moving Motivators, with questions such as, "How important are these motivators for you?" and "How satisfied are you currently regarding these motivators?" By repeating the survey twice yearly, the People unit can observe trendlines of motivation and satisfaction per unit, team, and even individual. By comparing metrics across team members, they can see why one team works and another doesn't.

In the end, the goal of BBVA Next Technologies is to offer employees a great place to work and to get early signals in case of deterioration of motivation or satisfaction and in case of people not fitting well in their current team environment. Nobody enjoys fixing problems that could have been prevented with better monitoring of the employee experience.

Conclusion

I believe there are several takeaways for both BBVA Next Technologies for further consideration:

In the future, the Delivery unit of the company might want to reorganize itself into multiple smaller Bases organized around specific customer value propositions;

I would suggest renaming the various PBI stages to Exploration, Validation, and Implementation (or other equivalents) that emphasize testing and testing;

At some point, the company might want to move away from its quarterly cadence of objectives and replace it with a continuous flow.

I also see several interesting things that are food for thought for the unFIX model:

Matrix structures are not going away any time soon. Instead of dismissing them completely, it's worth figuring out how to minimize the pain they can cause;

The multi-teaming approach, with people working across different teams in different contexts, offers the possibility to invent interesting parallel structures;

It can be good to have various roles per objective or team, and more research into typical roles would be a helpful way to expand the model.

Overall, I would say BBVA Next Technologies is half traditional and half unfixed. But for sure, the organized chaos is quite inspirational! 😁

===

Many thanks to Gerardo Barcia, Jorge Fernández, Javier Losa Muñoz, Sonia Sanz, Gonzalo Mosquera, Sara A. de Pablos, and Roberto Rodriguez for the time they made available for this case study.